Goldman Trader: "This Is Another Bear Market Rally Betapro2022-10-14 03:46:45

Goldman Trader: "This Is Another Bear Market Rally That Should Be Sold"

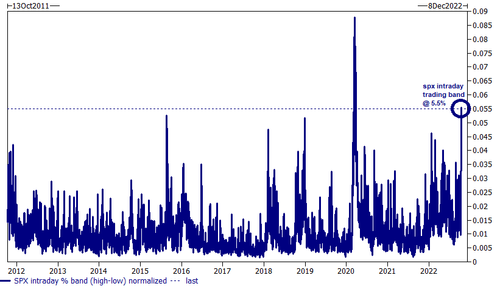

Today's dramatic reversal, which sparked an entire cottage industry trying to explain what's behind it, was a sight to behold (and forget if anyone shorted the bottom): the 5.55% intraday move in spoos as the market traded as low as 3502 (a YTD intraday low) early on only to rip after 11:30am (European close) into closing bell briefly rising as high as 3698, was the largest intraday move since March 25 2020, a period in which we saw intraday moves as big as 8.79% (however, back then the VIX was at 80). This is likely just the first of many such violent daily gyrations.

Here are some more remarkable market stats courtesy of Goldman trader Michael Nocerino:

“Today's 183.5 points trading range the largest for the SPX since 24th January this year when it had a 194.73 points range. Given lower spot level now the % range is considerably larger. Today's 5.03% SPX trading range the largest since 18th March 2020 when it had a 7.22% range (the SPX closed 2,398.1 then).”

On 9/13 (last CPI print) the S&P fell 566bps...high to low...mkt closed -423bps that day. On today's CPI...we reversed 560bps from low to high in the S&P.

ETFs end the full day @ 39% of the tape, just shy of the 40% all-time high (full day...intraday ATH high of 44% was made today)

Today’s 3600 calls at one point today were $0.30 and now they are worth $77

A crazy day in the market was not nearly as crazy on the Goldman trading desk however, as Nocerino recounted today's action:

DESK ACTIVITY…Wow…One of the sharpest intraday reversal’s we’ve ever seen - the largest since March 25, 2020...but our activity levels didn’t match up to the explosive levels of volume on the tape.

We were active, but we did not see LO’s buy this move as it seemed like they kept sitting on cash. Hedge funds ended with a 10% buy skew, explaining some of the bid to the market - but what really painted the picture was the record levels of ETF volumes (+44% of the tape at one point, and ending the day @ 39% just shy of all time high 40%.).

This rally higher had the markings of an aggressive macro short cover, with a lot of the activity likely in the pipes. Our client conversations line up with our flows, with minimal activity levels into earnings relative to historical standards.

This move also indicative of just how light positioning is. On a day like today, we’d usually see our lower quality baskets outperform - but today, we saw just the opposite with the marking of a reflation trade: Non Profitable Tech (GSXUNPTC) -.87% / China ADRs (GSXUCADR) - .8% / Expensive Software (GSCBSF8X) - .55%. A rally like this after a print as negative as this morning's should be met with some skepticism.

......