加息期间,美国股市回报其实还不错 (转一篇文章) trimtip2022-01-15 19:14:11

Get ready for the climb. Here’s what history says about stock-market returns during Fed rate-hike cycles

https://www.marketwatch.com/story/get-ready-for-the-climb-heres-what-history-says-about-stock-market-returns-during-fed-rate-hike-cycles-11642248640?siteid=yhoof2

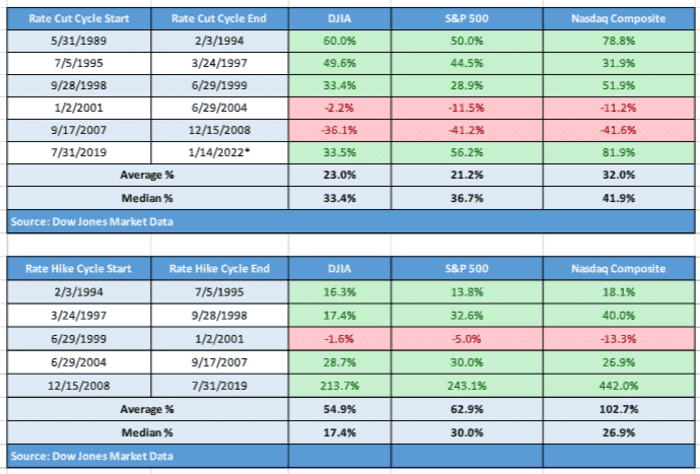

In fact, during a Fed rate-hike cycle the average return for the Dow Jones Industrial Average DJIA is nearly 55%, that of the S&P 500 SPX is a gain of 62.9% and the Nasdaq Composite COMP has averaged a positive return of 102.7%, according to Dow Jones, using data going back to 1989 (see attached table). Fed interest rate cuts, perhaps unsurprisingly, also yield strong gains, with the Dow up 23%, the S&P 500 gaining 21% and the Nasdaq rising 32%, on average during a Fed rate hike cycle.